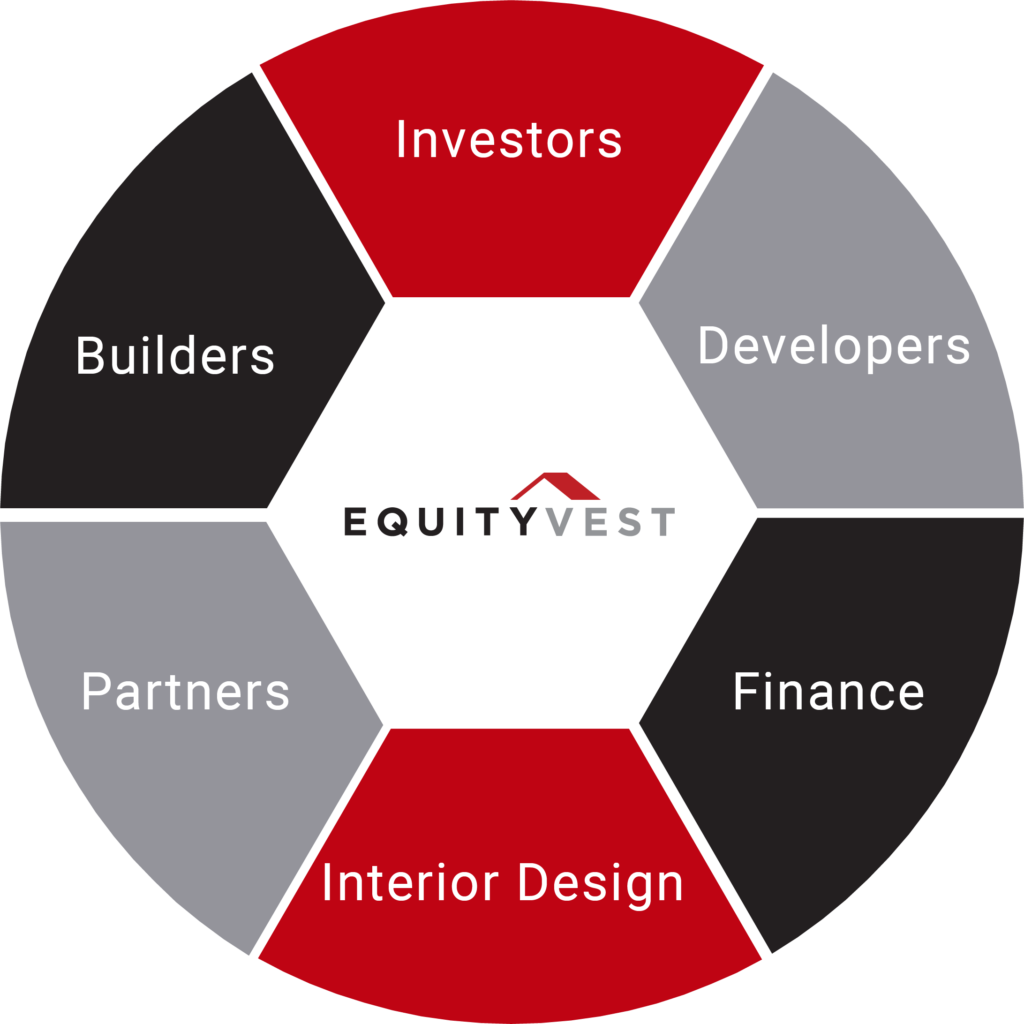

How We Work

Invest in local real estate through a more accessible and simple process.

We are the Forefront of Real Estate Investment and Development

By enabling direct investment in local real estate projects, investors who live in those areas enjoy a more familiar, hands-on experience with their investment—particularly those interested in shaping the look and feel of their local communities.

South Bay

Geographic Focus

Focused in luxury communities in the Southbay and Westside

New Development

Ground-up residential and commercial construction projects

Renovation

Remodeling older homes to give them the luxury look of a brand new home

Partnerships Matter At Equityvest

We are actively open-minded and inclusive in the way we choose our partners, grow our network, find and select our projects, design our platform and serve our investors

Development Companies

Our proven developers are the backbone of our projects

Trusted Partners

Our designers are proven industry professionals

Fully Documented

The projects we invest in are fully approved and permitted

Vetted Companies

Our partners are well capitalized and industry compliant

A Team of Experienced Professionals

We engage with top quality builders, developers, capital providers, and real estate agents to build state-of-the-art residential and commercial buildings. We search for and participate in quality projects with the highest investment potential.

Utilizing decades of experience, we strive to maximize returns for our investors through well-honed decision-making and collaboration with our local community of partners and consultants.

What Steps Do I Take?

Step 1

Contact Us

Reach out to us and learn about our fund offerings

Step 2

Investor Accreditation

Ensure that you are an accredited investor

Step 3

Fund Prospectus

Review the Equityvest fund prospectus

Step 4

Fund Documents

Receive, review and sign the documents

Step 5

Join Our Community

Become an Equityvest fund member

All investors are required to sign the Subscription Agreement, Confidential Disclosure Statement, and Operating Agreement.

The timeline for either an Investment Project or a Development Project typically takes 2 to 3 years involving site acquisition, permitting, construction, and sale at completion.

Upon signing and returning the three documents (Subscription Agreement, Confidential Disclosure Statement, and Operating Agreement), 20% of the investor’s purchase price in the fund is due. The remaining 80% is due within 5 days of notification that the capital raise has been achieved and a project has been identified for investment.

Each investor will have membership interest in the fund based on their pro-rata investment amount.

The administration fee owed to Equityvest, LLC is based on the funds raised and invested in a project. The fee pays for administration costs incurred setting up the fund and investing the fund directly in a project.

Equityvest, LLC will provide periodic updates on the fund raise, project selection and investment, construction progress, sale, and capital distributions back to investors.

No, the preferred return is not annualized. Each investor will receive a preferred return on their capital investment during the project’s timeline, which typically entails 2 to 3 years from site acquisition to disposition of the completed project.

Equityvest, LLC is the sole manager of the fund.